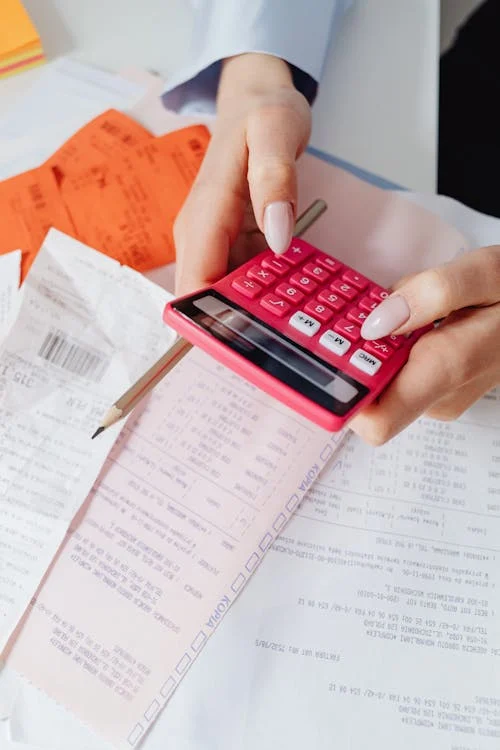

- FAST CAPITAL

- CREDIT LINE

- Equipment Financing

- Invoice Factoring

Immediate funding to cover operational costs, bridge cash flow gaps, or seize growth opportunities.

Access funds in as little as 24 hours with minimal paperwork.

Flexible credit options designed to keep your business moving forward. Use it when you need it,

repay when you can—ideal for managing variable expenses.

Whether upgrading or purchasing new equipment, our financing solutions let you spread the

cost over time while keeping your cash reserves intact.

Say goodbye to delayed payments. Convert unpaid invoices into fast, reliable cash

to keep your operations running smoothly.

Business line of Credit

Access cash fast and easy when you need it.

Payment Processing

We provide tech-focused and flexible payment processing solutions at the most competitive rates while upholding best-in-class customer service.

Term Loans

A business term loan is a lump sum of capital that you pay back with regular repayments at a fixed interest rate—this type of traditional financing is what most people think of when it comes to small business loans.

Small Business Loans

A small business loan is designed to give small businesses fast access to funding to cover short-term capital needs. Typically, short-term business loans are used for managing cash flow, handling emergencies and unexpected opportunities, as well as bridging larger financing solutions.

Equipment Financing

Equipment financing is a business loan that provides capital for purchasing new or used equipment, such as vehicles, machinery or technology. Equipment loans may fund up to 100% of the value of the equipment you want to purchase. These loans are repaid over time with interest.

Commercial Financing Asset based Lending

LendCap Management offers loan products and programs for commercial real estate loans. Commercial properties include: office, industrial, mini-storage, hotels, multi-family, and retail.

SBA 7(a)/504 loan

An SBA loan is a business loan that is partially backed by the Small Business Administration (SBA). It offers low-interest rates, and long repayment terms. These favorable terms can help both younger businesses and established businesses who may be looking to expand or improve their cash flow. With the flexibility to utilize the funds for a variety of uses, it’s designed to help you take your business to new heights!